Yesterday the Congressional Budget Office (CBO) released a report on the dire economic consequences that the U.S. will face if its do-nothing government actually does nothing for the rest of this year and allows all of the temporary and sun-setted tax breaks, including the massive Bush tax breaks, to expire and follows through on the negotiated budget cuts from last year's debt deal. The CBO colorfully but aptly describes this scenario as a "fiscal cliff."

Yesterday the Congressional Budget Office (CBO) released a report on the dire economic consequences that the U.S. will face if its do-nothing government actually does nothing for the rest of this year and allows all of the temporary and sun-setted tax breaks, including the massive Bush tax breaks, to expire and follows through on the negotiated budget cuts from last year's debt deal. The CBO colorfully but aptly describes this scenario as a "fiscal cliff."The attention-grabbing conclusion from the report was that going over the cliff would plunge the economy into recession, with growth slowing later this year and falling by 1.3 percent during the first half of 2013. Given the already weak state of the labor market, unemployment would likely soar. The only bright spots in the analysis were that the federal deficit would fall by $560 billion (the very definition of a fiscal cliff) and that deficits over the following decade would become sustainable in the sense that they would be smaller than the growth in economic output.

Less attention, however, is being given to other parts of the analysis. In particular, the U.S. is almost certainly going to adopt some fiscal "restraint" next year. Even if the Bush tax cuts are renewed, it's doubtful that all of the current stimulus measures, such as the payroll tax cut and extended unemployment insurance benefits, will be continued. Also, it's likely that some or all of the $65 billion in budget cuts from last year's debt deal will go through. The effects of these restraints will be sizable, reducing economic growth from 4.4 percent if all of the stimulus and spending were continued to 2.1 percent if just the stimulus were removed. Thus, the U.S. is facing a stiff economic headwind even with a more modest policy.

The CBO analysis also provides insights into the consequences of Republicans' calls to cut-cut-cut spending, while preserving the Bush tax cuts. Spending cuts large enough to offset the deficit impacts of the Bush tax cuts would be as much of a cliff as the do-nothing approach and would have devastating effects on the economy.

The bigger lesson is that there are no costless approaches to addressing the deficit. However, it must be addressed. The question is whether the U.S. will do this in a responsible, balanced way that maintains economic growth while addressing both revenues and spending through a transition period.

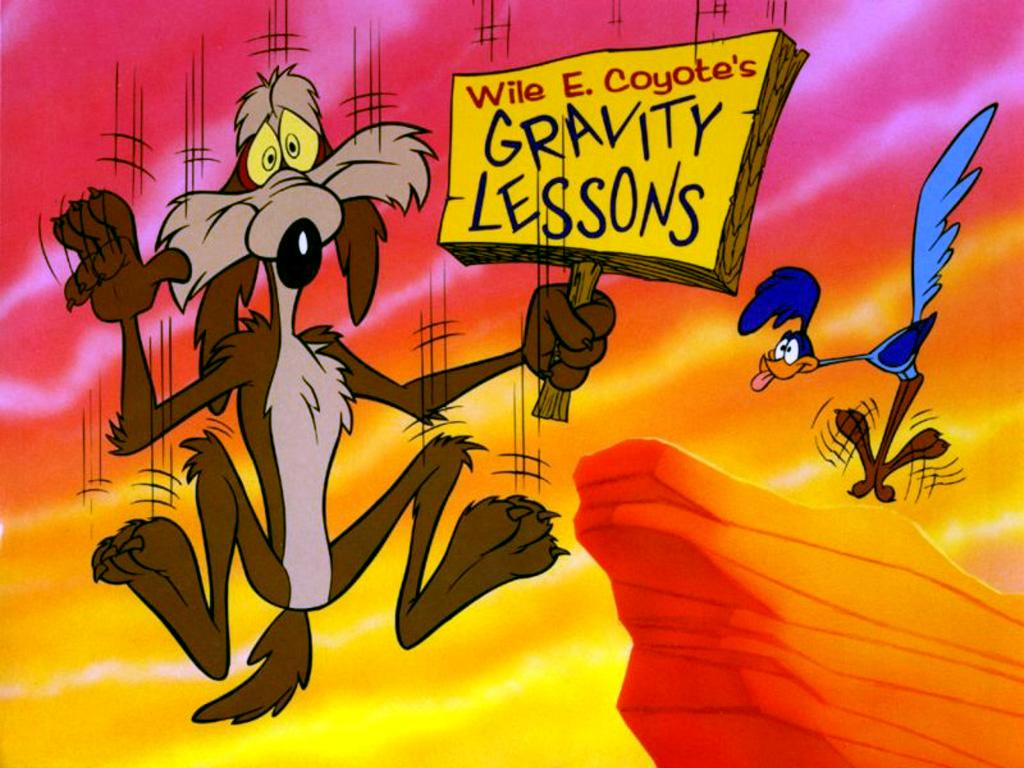

Unfortunately, our "leaders" have taken a lesson from Wile E. Coyote--going off a cliff doesn't matter if you don't look down.